Compare Competitive Rates from hard money lenders in Atlanta Georgia

Wiki Article

Comprehending the Fundamentals of a Hard Money Financing: Your Comprehensive Overview

Navigating the world of real estate funding can be intricate, especially when it comes to difficult Money fundings. As an alternate form of financing, these car loans play a vital duty in residential property investment strategies, yet they stay shrouded in enigma for several (hard money lenders in atlanta georgia).

What Is a Hard Money Lending?

a Hard Money Funding, typically watched as a monetary lifeline, is a certain kind of asset-based financing. It is normally provided by exclusive capitalists or firms as temporary car loans based on the residential property's worth rather than the debtor's credit reliability. The appeal of this Financing rests on its rate of issue, bypassing the lengthy authorization process of standard car loans.How Does a Hard Money Loan Job?

Ever questioned just how a Hard Money Lending features? Essentially, it's a short-term Financing, typically utilized in actual estate deals, safeguarded by the residential property itself. This sort of Finance is mostly utilized by capitalists seeking fast financing without the stringent requirements of traditional financial institutions.

In a Hard Money Loan, the customer gets funds based on the worth of the home, not their credit reliability. The loan provider, commonly an exclusive individual or firm, analyzes the home's value and offers as necessary. The process is quicker than conventional financings, typically completed within days.

However, hard Money loans come with higher rates of interest and charges because of the increased risk. When the customer can not certify for other funding choices., they are normally used for fix-and-flip projects or.

Comparing Tough Money Financings and Traditional Financings

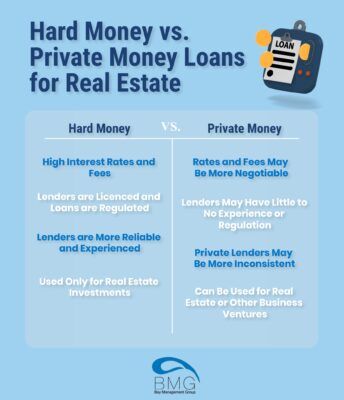

While difficult Money car loans and traditional fundings both work as funding options, they vary considerably in numerous elements. Standard car loans, often given by financial institutions or lending institution, normally have lower passion rates and longer-term repayment timetables. They call for extensive credit scores checks and proof of income, which can lead to a prolonged authorization process.On the various other hand, hard Money lendings are usually released by exclusive capitalists or business. The collateral for the Financing is typically the residential or commercial property being purchased.

Advantages and Downsides of Difficult Money Car Loans

Despite their higher rate of interest, hard Money loans supply numerous notable benefits. Largely, they are much faster to procedure than conventional lendings, which can be crucial for time-sensitive investment opportunities. hard money lenders in atlanta georgia. These car loans are normally based upon the residential property's worth as opposed to the debtor's creditworthiness, making them an attractive alternative for those with bad credit or that need a swing loanHowever, the drawbacks of tough Money loans need to not be neglected. The abovementioned high rate of interest can make these car loans cost-prohibitive for some borrowers. In addition, because these loans are commonly short-term, they may not suit those needing long-lasting funding. The lack of government guideline can lead to much less security for customers, potentially resulting in predacious lending practices.

Leveraging Tough Money Loans for Real Estate Investments

Verdict

Hard Money lendings, while costly, offer a practical service for those looking for quick, short-term financing genuine estate purchases and renovations. They are largely asset-based, concentrating on the property's value as opposed to the borrower's credit reliability. However, their high rate of interest and temporary nature necessitate careful planning for settlement. Recognizing the fundamentals of hard Money lendings is essential for any possible genuine estate investor.The charm of this Finance rests on its speed of issue, bypassing the lengthy authorization procedure of traditional car loans. Contrasting Difficult Money Car Loans and Traditional Finances

Unlike typical car loans, tough Money financings are not primarily pop over here based on the debtor's credit reliability yet on the value of the home being acquired. hard money lenders in atlanta georgia.

Report this wiki page